Ember’s European Electricity Review: the history and future of world energy

Make baby make, not drill baby drill

Intro - Ember’s European Electricity Review*

In our tour of world energy afforded by Ember’s open data let’s start with a close look at Europe before we widen the lens.

Ember’s update of the progress of wind and solar in the European power sector is a paean to the progress and now deep impact of the energy transition.

They make it a simple tale because it is a simple tale – and it has a simple goal, to triple renewables, and double energy efficiency, by 2030 to meet the Paris climate goals set in 2015.

Will we make it ?

Well, read on.

The back story to all this has been the rapid rise of manufactured, scalable, industrial-size, clean energy technology (wind / solar) and how it will surpass and substitute fossil fuels at local, regional, and global scale – and thus meeting those goals.

So now this technology has reached the point where it can be quickly deployed at major scale - feeding off all the benefits that were expected (lower cost, more energy resilience, reduced waste).

Ember’s latest data shows us how we have now reached an historic milestone in the journey.

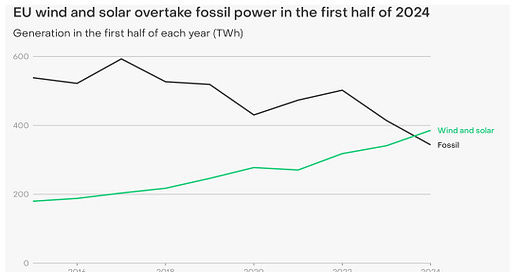

In the first six months of this year Europe wind and solar alone produced more electricity than fossil fuels for the first time.

And, given the nature of scalable manufactured energy this growth will continue quickly and consume any fossil fuel future growth pushing it fast into decline.

Chart 1 speaks for itself, and the future of this trend looks obvious. It does not guarantee (yet) we meet the Paris goals, but it is a major step forward.

Chart 1

Add in fellow non-fossil-fuel travellers such as hydro-electric power and nuclear energy you can see how the expensive and wasteful fossil fuels are quickly forced from the electric grid – which is the plan.

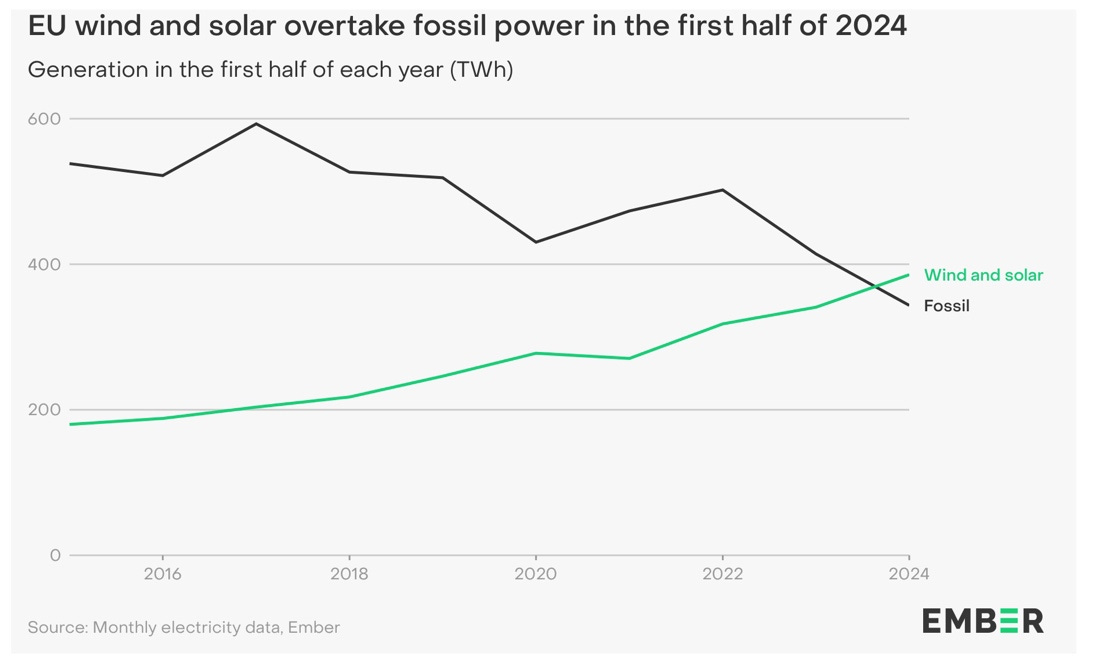

Chart 2

The arithmetic is plain: in a half-year when overall electricity demand grew by 9TWh from 2023, wind and solar increased by 44 TWh, other renewables 42TWh meaning supply outgrew demand by 77TWh.

And what happens when energy supply out-paces demand: 77 TWh of fossil fuels exit the grid.

Chart 2 will be repeated and repeated across countries and continents and grow larger until we have the global the global chart looking the same – which may happen this year too, or if not, very soon.

And this shift comes with the added benefit of vastly reduced emissions - less waste, less pollution, less high-risk future environmental impact.

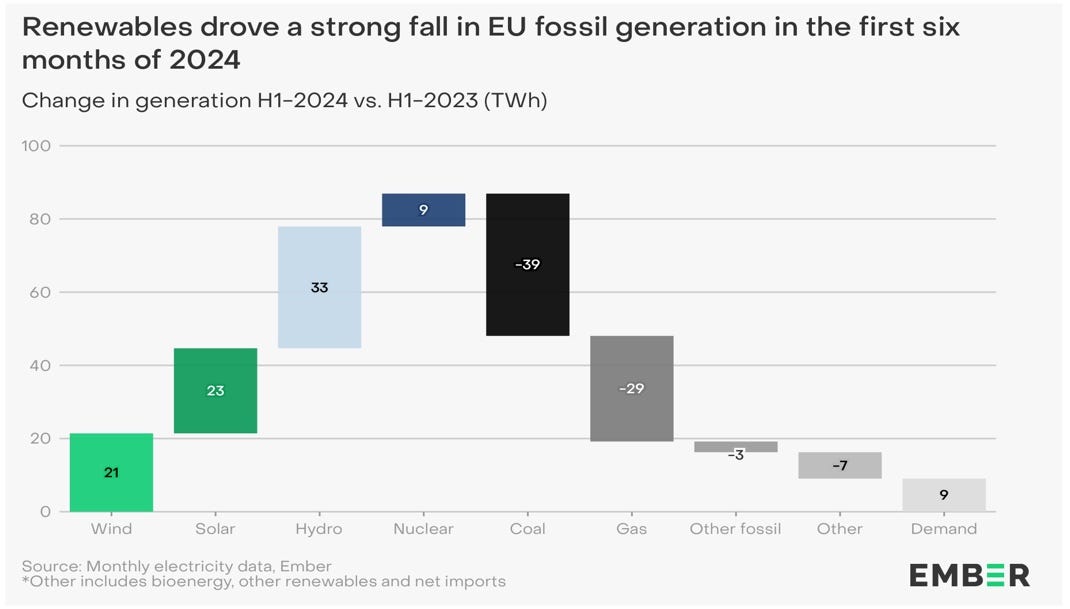

Chart 3

As waste decreases, efficiency increases: the inverse of chart 3 is the increase in energy efficiency – more renewables, more efficiency, we continue to make strong progress to the Paris goals.

Taking a step back – smell the flowers, recognise a new energy era

It is worth pausing to consider that, as Ember note, since peak emissions in European power 2017, and with all the societal and political turmoil since then, emissions are 45% lower, and still declining fast (down a third from 2022 to 2024).

Smell the flowers – this is a big achievement, and vindication of decades of investment, technical improvements and policy endurance.

And, as a geopolitical aside, the performance and growth of wind and solar has allowed Europe to now begin (quickly) a new era of far lower dependence on gas consumption, which has largely been imported – from either unreliable states such as Russia, or the global markets which have been volatile.

Wind and solar’s growth now provides Europe with a controllable regional energy technology solution that it can continue to grow, and reduce energy risk.

On that uplifting note let’s quickly put the European power sector story in context and see the picture in other key players: the US, China, Russia and Saudi Arabia.

We’ll use Ember’s global data tool here – same data source as the European analysis above but this time including all energy sources as they stood at end 2023

The comparison is enlightening.

The history and future of world energy: make baby make

Note - the reason the global electric power sector is so central to energy’s future is that it makes up over 40% global end use energy today – growing at 3-4% per year. And as other energy sectors electrify such as transport and heating, by 2030 it will rise to over 50%, the majority of world end use energy – and still growing quickly.

How countries choose to manage to supply the power sector, and develop opportunities from it will be the great energy game of the 2030s and beyond.

In this context, let’s review Europe again to start.

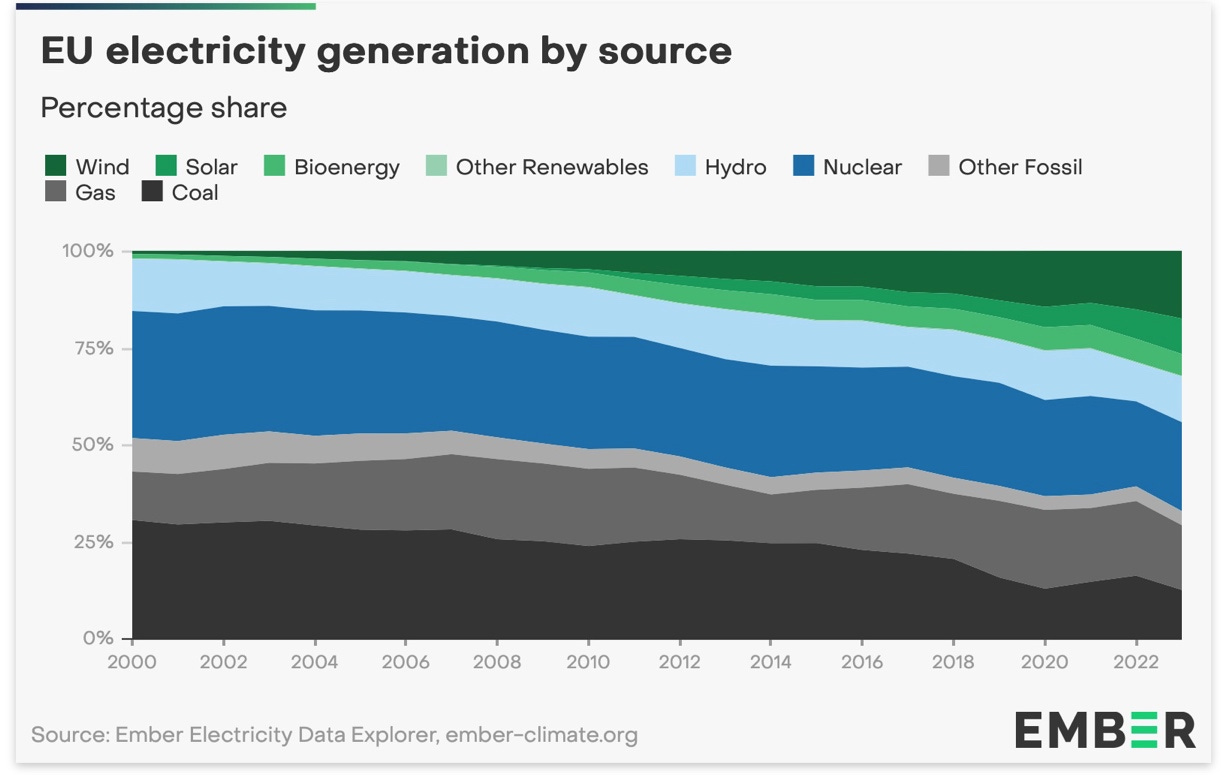

Chart 4 – Europe – the beginning of new resilience

We can see the wind / solar impact on the EU ability to create a portfolio of energy choices, necessity inventing new technology options.

The Russia gas removal accelerated a movement already underway – it’s problematic it took such an event to manage such a clear risk, but it cements the EU’s determined and accelerated move to renewables, and its rational mission to remove fossil import dependence.

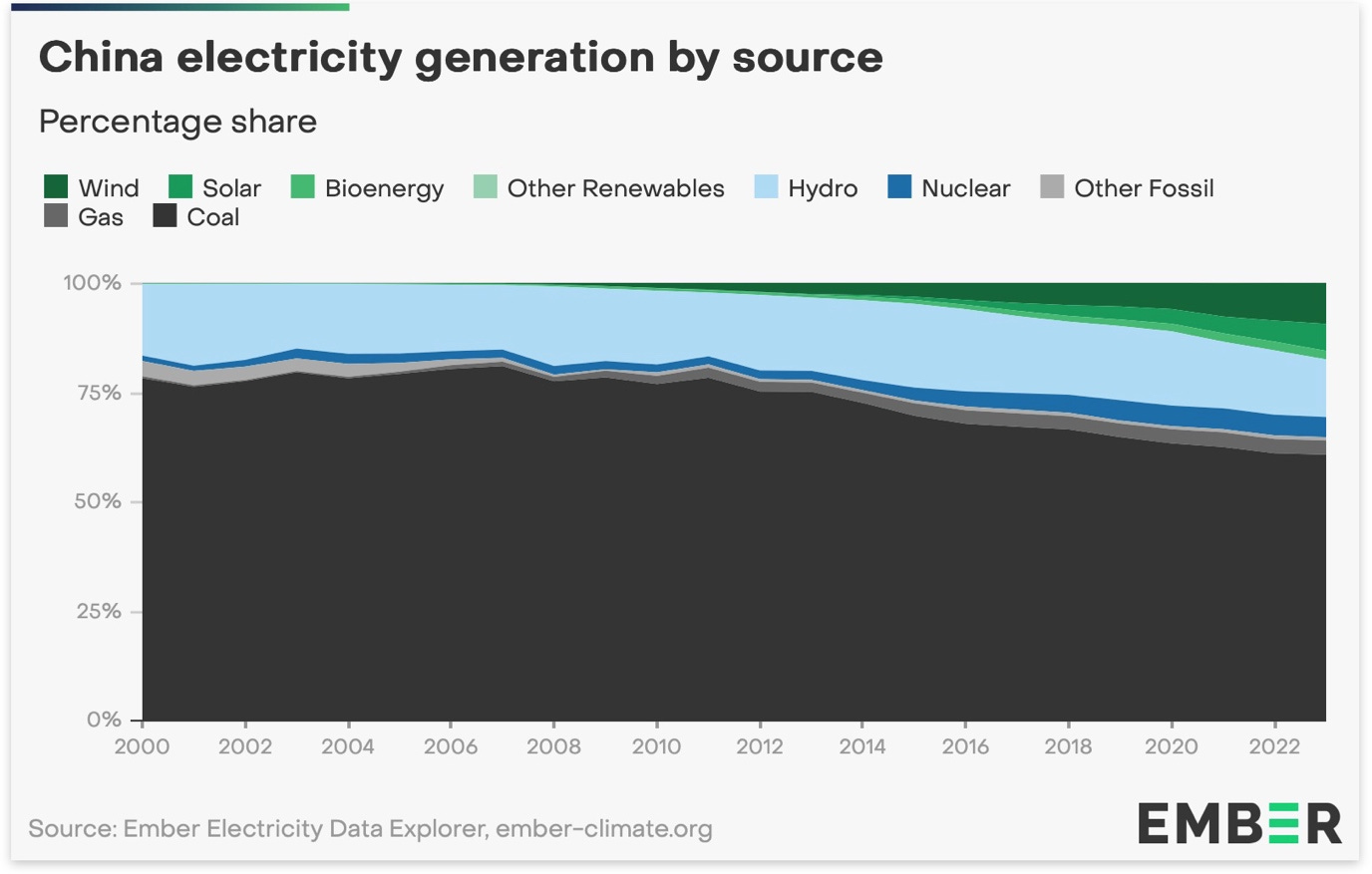

Chart 5 –China - Necessity invents energy dominance

China, like Europe, is bereft of significant domestic oil and gas, but has massive local coal resources, and huge manufacturing expertise.

It has chosen logically then to avoid further oil and gas fossil dependence by pivoting hard to technologies of solar and wind and EVs, whilst leveraging its domestic coal resource to squeeze out the remnants of imported oil and gas.

China is not driven purely by emission reductions targets as a priority – but it knows import dependence and energy inefficiency when it sees it, and the opportunity to exploit new energy technologies.

An enormous by-product of its competitive advantage in manufacturing is its almost instant leadership of the vast growth in renewable energy technologies – which contrasts with US energy strategy as we outline below.

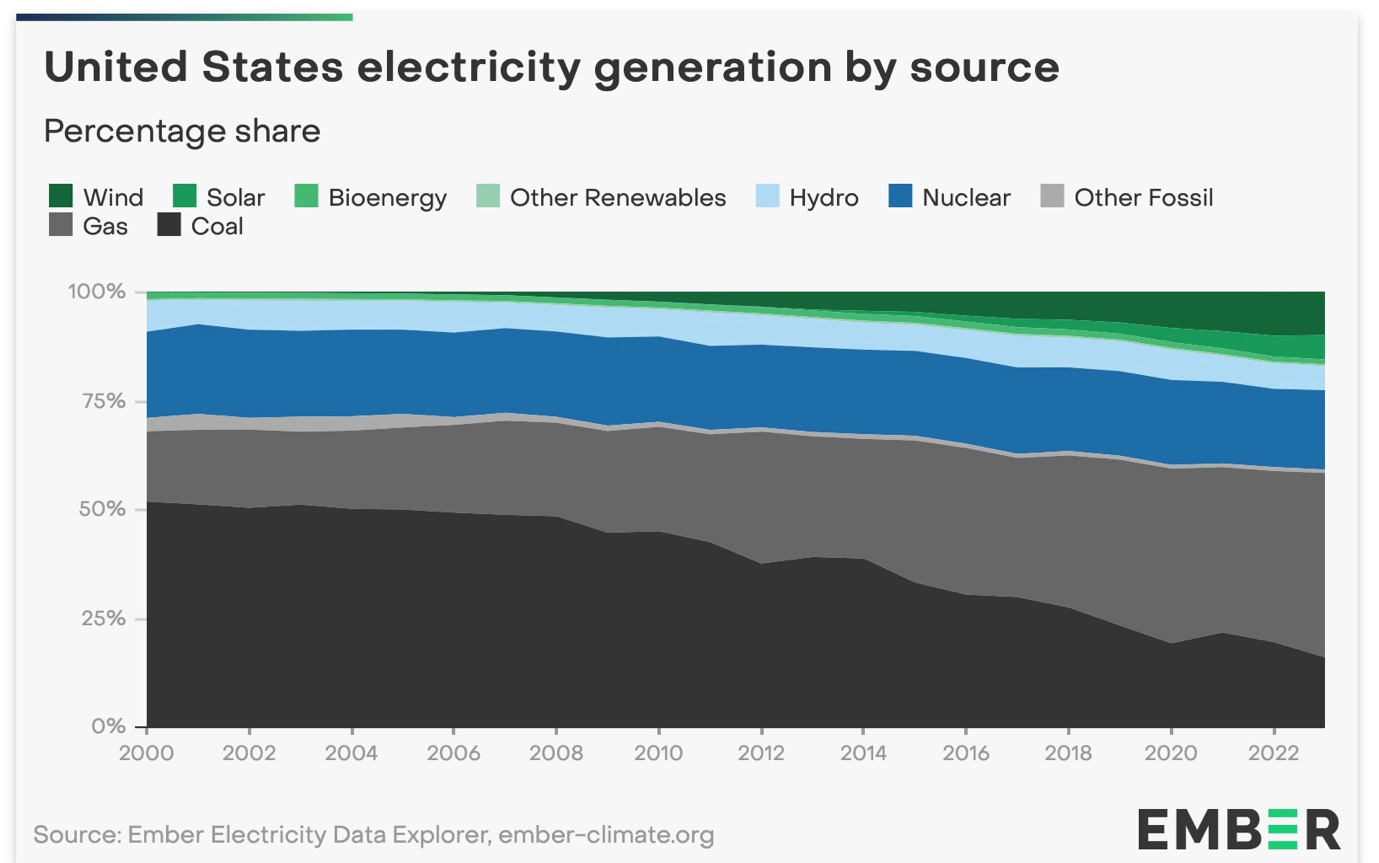

Chart 6 – The US – The curse of plenty

Blessed with lots of gas and coal (and oil) plus technology expertise for wind and solar and EVs the US has had multiple energy choices. Turns out this becomes a distraction with competing industries demanding energy leadership and support.

Energy excess is good in one sense – but it means that in terms of renewable technologies, and future energy leadership in general, it is a curse.

It has lost a lead to those like the EU and especially China who have been more reliant on creating manufactured technologies whilst the US attempted to use “all of the above”.

So, while the US still has to deal with the lure and pull of drill baby drill, China has spent many years focussing on make baby make.

The US has leant on domestic gas heavily, and failed to invest hard on alternative technologies – relying too much on the fiat of entrepreneurs rather than strategic direction.

And perhaps even now expend vital capital on alternative currencies rather than the harder yards of alternative energy.

Thus, China, not the US is now the largest maker of EVs in the world, largest exporter of EVs in the world, and the largest maker of lithium-ion batteries in the world.

The US with so much energy resource in principle has in fact ceded future, sustainable manufactured energy leadership to China – conceivably for good.

Finally – what of electricity generation trends in the major global fossil fuel exporters – Russia and Saudi Arabia

Let’s keep it uncomplicated

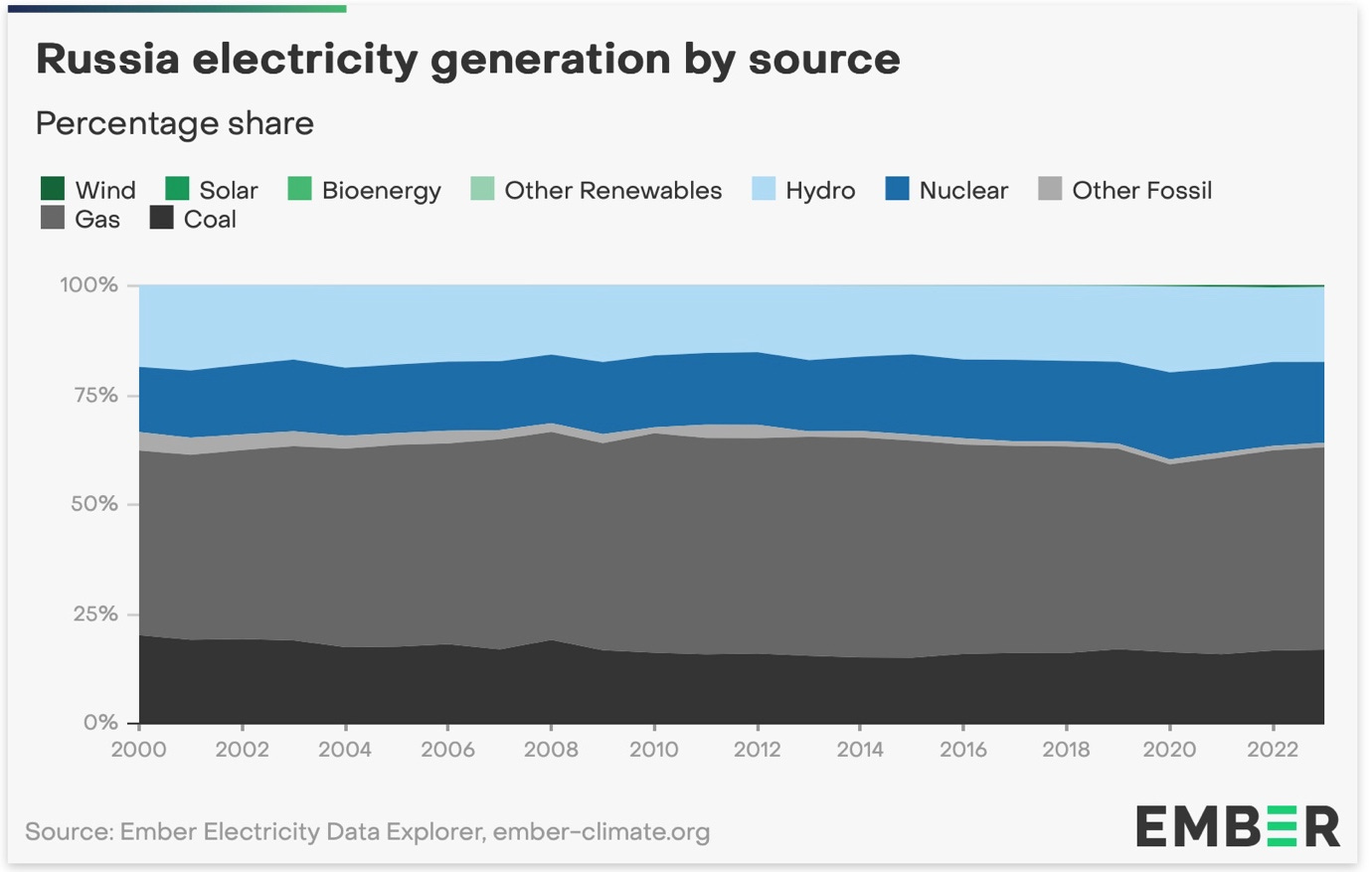

Chart 7 - Russia – energy prison – its energy history is its endless energy future

Russia has chosen an unchanging energy landscape with no investment in modern energy technology.

Its self-imposed energy prison is summarised clearly in its power energy mix: flat, rigid, no vision of the future of energy.

Its energy history, mostly fossil (with some aging hydro-electric and nuclear plant assets) is its energy future - stretching out forever across the fossil reservoirs beneath its vast unchanging steppes.

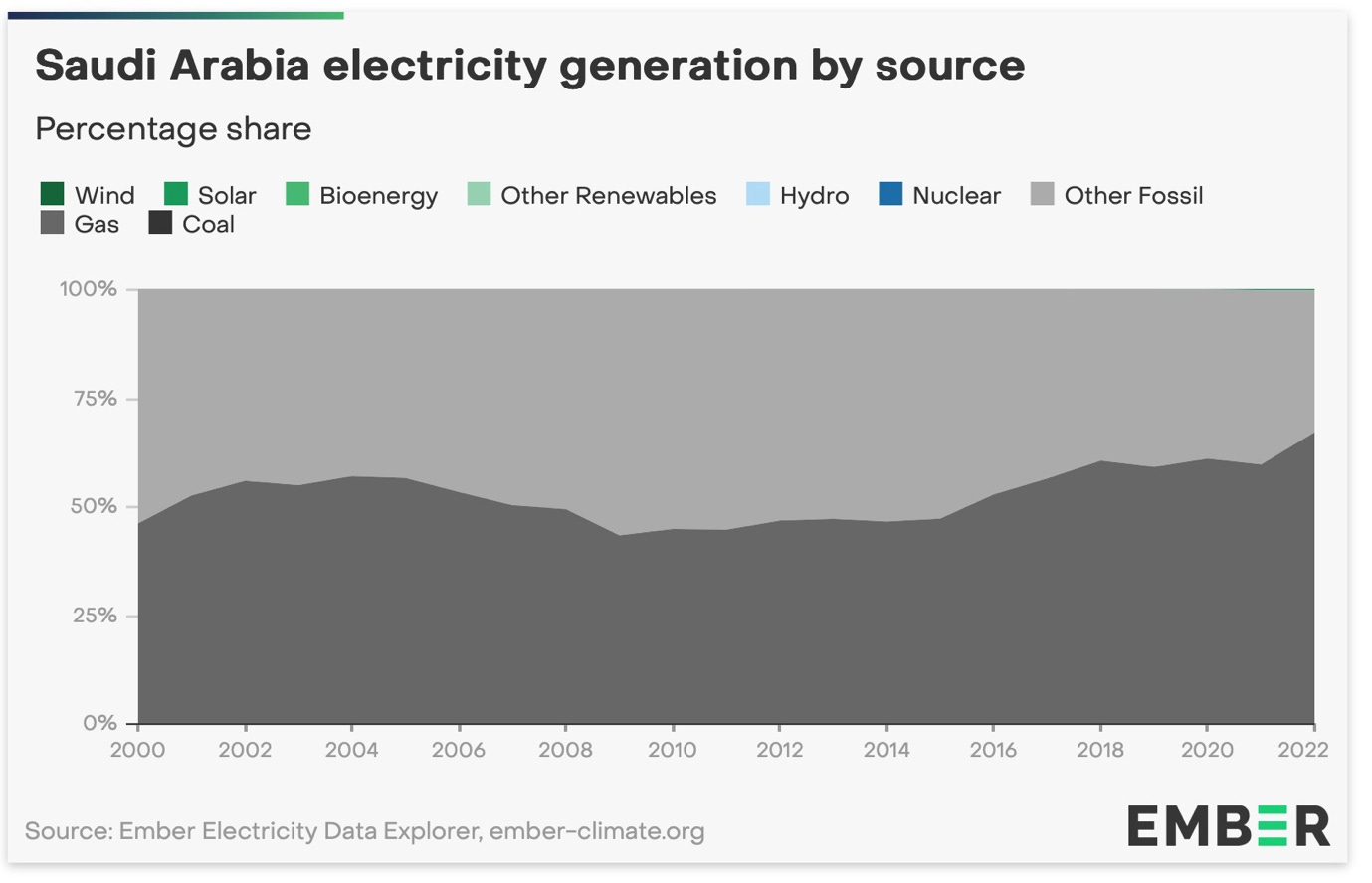

Chart 8 - Saudia Arabia (aka OPEC) - Mordor

One ageless energy function, to export fossils forever.

*note - as Chair of Ember this is my own analysis using their open data - the views are my own, you are all free to review the data directly and reach other conclusions - I lay my working out here because their data is accessible to me and to you