Leaving the battlefield: oil companies are quitting renewables, yes, but also quitting energy

The future of energy is clearly being left to others

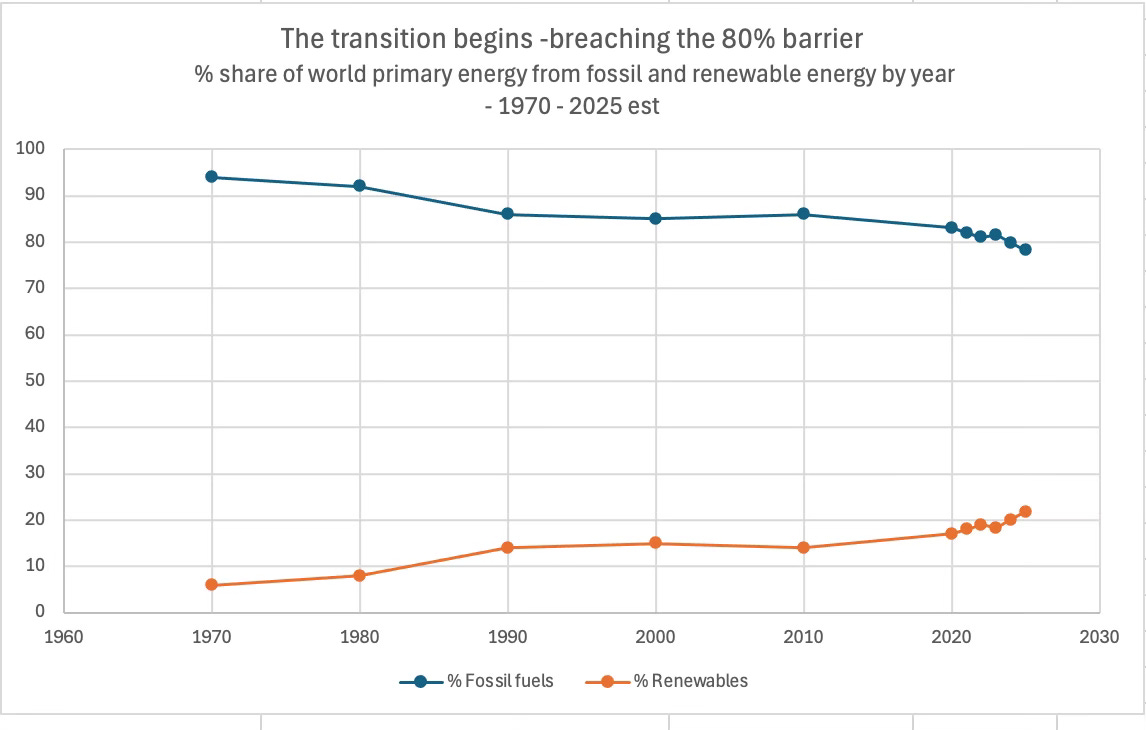

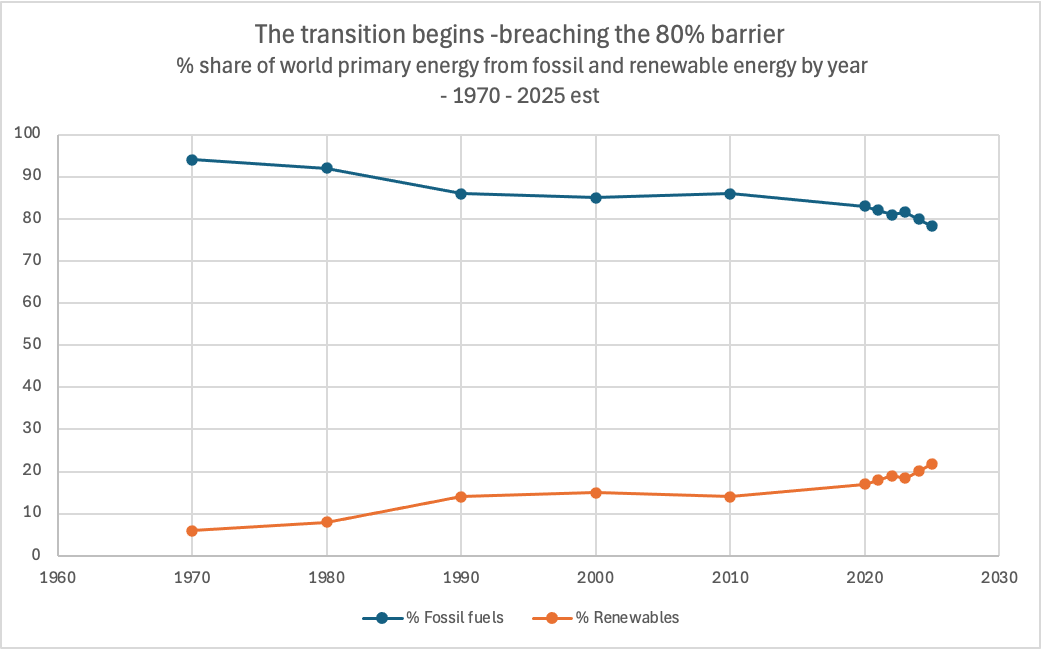

In 2024 fossil fuels dropped below 80% of global primary energy for the first time in modern history, and oil’s share dropped below 30% for the first time too.

Oil and gas companies have reacted rationally by exiting the battlefield of energy growth, whether renewables or fossil fuels, and giving cash to shareholders instead.

The future of energy is clearly being left to others: for oil and gas investors, caveat emptor.

The oil majors retreat from energy, leaving energy’s future growth to others

According to a new IEA report published this week – which we’ll review more below -

it reveals three tipping points in the modern energy era:

· fossil fuels dropped below 80% of global energy, for the first time

· oil fell under 30%, for the first time

· gasoline/diesel demand peaked

Fossil fuels’ share of global primary energy fell below 80% for the first time in modern history, a tipping point masked by growing energy demand.

Oil’s share of primary energy fell below 30% for the first time in modern history, down a third from its peak.

The demand for gasoline and diesel was negative – 2024 may be the year road transport fuel demand peaked– no more growth in this sector anymore.

Three milestones that show whilst the energy evolution is not perfect, it is happening nevertheless, and at pace.

Even as absolute energy demand still grew, it is telling that many oil majors such as BP, Exxon and Shell, who have recently noted their exit from renewables, are also withdrawing from core oil and gas production investments too.

Over 50% of their operating cashflow is now going to shareholders, not explorers or construction crews.

Source – company accounts of IOCs / NOCs, Goldman Sachs

So they are not just quitting renewables, they are quitting energy growth of all types.

Their retreat from renewables isn’t a setback for energy evolution, it’s the opposite; it’s foreshadowing that the future of energy is being built around them, not by them

The transformation of energy does not need oil companies to lead; it needs them to phase down while new industries phase up.

And that seems exactly what is happening.

Oil’s tactical retreat

Critics mistake oil and gas industry withdrawals from renewable investment for obstructionism, but it is better understood as tactical retreat from all energy, including fossil fuels.

And as we’ll see, as they played a bit part in investments into new energy technologies, their withdrawal only merits a passing glance, and has no bearing on energy’s transformation.

The energy evolution is not flawless.

But it is going well, and the drop in share of primary energy demand of fossil fuels, oil company tactical retreats from future energy investment of all kinds, the peak in road fuel demand – all signal that a large and structural change is well underway.

As evidence let’s take a look at two examples of this reality from this month – the IEA Global Energy Review 2025 Report, and Shell’s latest announcement about reducing renewables investments, and ramping down its capital expenditure on fossil fuels

1. IEA Global Energy Review 2025 – Energy Demand Grows, but it is decoupling fast from fossil fuels

Even as overall energy demand grew 2.2% in 2024 - a jump from 1.7% in 2023, - the report highlighted the fast-changing role of fossil fuel impact

Fossil Fuels Declined 1.6 Percentage Points of primary energy (2023–2024):

· They dropped from 81.6% to just under 80% of primary energy despite global energy demand growing by 2.2%

· Fossil fuel share of world energy at persistently above 80% is often cited as its permanence and dominance – this type of drop off signals a transition point.

· Oil’s primary energy share fell below 30% for the first time in modern history (down from a peak of 46% in the 1970s) – this indicates the turmoil of change within the fossil fuel sector

· Meanwhile renewables rose again: Wind and solar alone supplied 15% of global electricity in 2024, up from 10% in 2020. China’s BYD became the largest seller of electric vehicles in the world, with sales increasing by 30%.

· Meaning faster and deeper decoupling of energy from fossils: Despite global energy demand growing fossil fuels’ share continues to decline as renewables (wind, solar, hydro, batteries) and nuclear meet most new demand.

· Global emissions grew weakly at 0.8% even as total energy demand grew 2.2%, and global GDP 3% signalling the decoupling of energy from fossil fuel influence.

The IEA’s latest analysis underscores that renewables are now the structural driver of global energy growth.

In addition their fast-falling costs and inherent benefit to energy security (dispersed technology, shorter local supply chains, stocks of energy lasting for years) will only hasten this shift.

Even as overall energy demand growth persists, supply is now being rebalanced in favour of renewables.

The chart below shows the gradually then suddenly nature of this move: expected when an exponentially growing energy source (renewables) meets a large but slow-growing fossil fuel system.

Of course near-term climate risk goals are still undermined, but the far-reaching energy change is now substantial, and the global energy system is at the threshold of being transformed.

source – IEA Global Review 2025, EI

This is seen most starkly in oil - the IEA’s findings confirm that oil’s role in the global energy system is eroding structurally, even as demand persists in niche sectors:

· Oil demand growth slowed to 0.8% in 2024, down from 1.9% in 2023.

· The disruptive impact of electric vehicles (EVs). - Growth in road transport oil use has collapsed to just 5% of total demand growth since 2022, and was negative growth in 2024.

· Growth is concentrated in a low-value niche - petrochemicals: Over 70% of recent oil demand growth (by volume) comes from feedstocks for plastics, driven largely by China. This is a low-value, competitive niche—not a growth engine. The future is not in plastics.

The energy transition is being propelled by external forces—EV adoption, policy shifts, and industrial innovation—not by oil producing company investments.

This means another breakthrough has been reached – the growth in road transport fuel demand – gasoline and diesel – is now likely over.

source – IEA Global Review 2025, EI

Oil is now becoming a specialized commodity rather than a driver of energy growth.

Only a few more years of current deterioration will push it below 25% of primary energy demand and into long-term absolute decline.

source – IEA Global Review 2025, EI

And oil and gas companies appear to sense this.

2. Shell: A Case Study in Tactical Retreat - Shell isn’t just quitting renewables, it’s quitting energy growth

Shell’s announcement that it will cut renewable spending (exiting offshore wind, hydrogen, and EV charging) hides the fact they are slowing down investment in oil and gas projects too.

Shell’s oil and gas production is down over 33% from its peak in 2016, and is mainly dominated by lower-margin LNG, not oil.

Source – company accounts, Goldman Sachs

Their forward strategy appears to be:

· Prioritizing cash extraction: Shell plans to boost shareholder returns to 50% of operating cashflow up from 40% last year. In this way it is following the industry - moving to cash extraction versus oil extraction.

· Abandoning “transition” optics: CEO Wael Sawan openly dismissed renewables as inadequately profitable, doubling down on gas, and especially LNG. But renewable investments were always tiny (2-4% of capital expenditure) so this announcement has no financial value, only optical merit.·

. Mimicking Peers: Like its peers, Shell is now framing itself as a “cash machine,” not a transition leader.

The chart below highlights this flight to cash delivery and not energy production by all oil companies, including Shell.

Source – company accounts of IOCs / NOCs, Goldman Sachs

Shell’s pivot exemplifies the industry’s tactical retreat from large-scale growth in energy investment of both renewables and fossil fuels.

Its actions confirm:

· Fossil fuel firms lack the expertise, margins, or incentives to compete in renewables.

· A future of structural declining oil demand means new oil and gas project developments are un-needed – cash to investors becomes a prime asset, and attraction for shareholders

· The new energy system does not require their leading participation—it is being built around them, not by them.

Why All This Matters

This oil and gas industry strategy is rational, but revealing. By prioritizing cash returns, many oil firms implicitly concede that:

1. The energy transition is inevitable, and demand for their core products will structurally decline.

2. Renewables are not their battlefield. Unlike startups or utilities, they lack the technical expertise or margins to compete in wind, solar, or batteries.

3. Their future is smaller and more specialized. Many now frame gas and carbon capture as their “transition” play—a far cry from leading systemic change.

Critics mistake Shell’s and other oil company’s renewables withdrawal for obstructionism, or even capable of slowing transformation, but it is better understood as tactical retreat.

By funnelling 50% of cash to shareholders, not oil and gas production or renewables, it’s admitting the energy future belongs to others.

The energy transition does not need oil companies to lead, it needs them to phase down while new industries phase up.

And this is what they are doing, whether they like it or not.

Caveat emptor.

Please note all these posts are all my own thoughts, with a bit of AI synthesis.

Unfortunate that they're pivoting to making the rich even richer instead of helping to solve the climate crisis they caused

https://www.iea.org/commentaries/the-relationship-between-growth-in-gdp-and-co2-has-loosened-it-needs-to-be-cut-completely

As the IEA show energy growth has decoupled from fossil fuels growth for a while now - also investment in clean energy is a fair chunk of eg Chinas GDP growth now

https://www.carbonbrief.org/analysis-clean-energy-contributed-a-record-10-of-chinas-gdp-in-2024/

- so as the new system grows energy gets more efficient - manufacturing vs extraction