Electrostate

Just one may be enough to start a new energy future

BYD sells more cars in a month than Tesla in a quarter

Key themes for a reader in a hurry:

The Energy Transition is progressing and maturing: The shift from fossil fuels to diverse, manufactured energy sources (solar, wind, batteries, EVs) is already well underway, driven by necessity (finite fossil fuels) and the industrial reality of rapidly improving costs and performance of large-scale energy technologies.

The core unit of energy supply diversifies from petrostates to include electrostates:

Petrostates (e.g., Saudi Arabia, Russia) rely on finite, geographically concentrated fossil fuels, leading to international economic dependence and geopolitical volatility, plus dependence on a depleting resource

Electrostates (e.g., China) thrive on manufactured energy technologies (solar panels, EVs, batteries), leveraging scalability, learning curves, and fast-growing export potential.

China is the First Electrostate

It dominates global electrotech manufacturing (80% of solar panels, 60% of lithium-ion batteries)

It leads domestic adoption (55% EV sales, 333GW solar installed in 2024, China domestic solar is 50% global solar capacity) leading to emissions peak in power as it displaces coal and gas.

It expands exports (30% global car export share, $200bn renewable trade surplus).

The creation of an electrostate reveals the future of energy: it is not just about swapping oil barrels with solar panels – it is a far larger concept, replacing a scarcity mindset with a scalability mindset

Energy Transfer rather than distribution: Unlike oil’s centralized distribution, electrostates enable decentralized, replicable energy technology transfer, without resource depletion.

Wider energy leadership: Distinct from petrostates which are determined by geological chance, any nation can become an electrostate through industrial policy and innovation - but China’s first-mover advantage is significant, but perhaps an accelerant for others

Increased energy choice: committing to commodity-based energy leaves little choice other than fossil fuels: moving to manufactured energy takes us all down a long wide path of innovation, if we choose it.

The Energy Transition – from Fossil Fuels to Manufactured Energy

The energy transition can be defined as the evolution of world energy from global dependence on extracted fossil fuels, toward the reliance on a wider variety of alternative energy sources of manufactured energy such as wind, solar, batteries, nuclear and others , as well as fossil fuels.

From the supply of fossil fuels and use in fossil-fuel devices in power, transport and heating, to the supply of electricity into each of those sectors, eg solar energy in power, and the introduction of new electricity demand such as electric vehicles in transport.

Once a technological theory, this shift is now an industrial practice.

Non-fossil fuels now create 42% of global electricity production, according to the latest Statistical Review of World from the EI (formerly BP), and electric vehicles will likely account for 26% of new road transport sales this year, over one in four cars sold.

This synthesis of renewable energy in power and increased electrification in demand is at the heart of the transition.

It forces us to consider that the energy transition is not the narrow classification of “switching to renewables”, or even the wider “electrify everything”.

It transforms how the future energy industry of the planet will work, and who works it.

But first, let’s look at the world of energy today.

Memento mori: Petrostates depend on a depleting resource, the energy transition is therefore inevitable, not optional

In our world energised by fossil fuels, the fundamental unit of energy supply is the petrostate: the nation states that trade their oil and gas to others, to allow those consumers to work their economies.

About 10 countries export significant amounts of oil and gas, the rest of us – another 180 countries, import it: and given that even petrostates consume oil and gas for energy too we are all petro-dependent states.

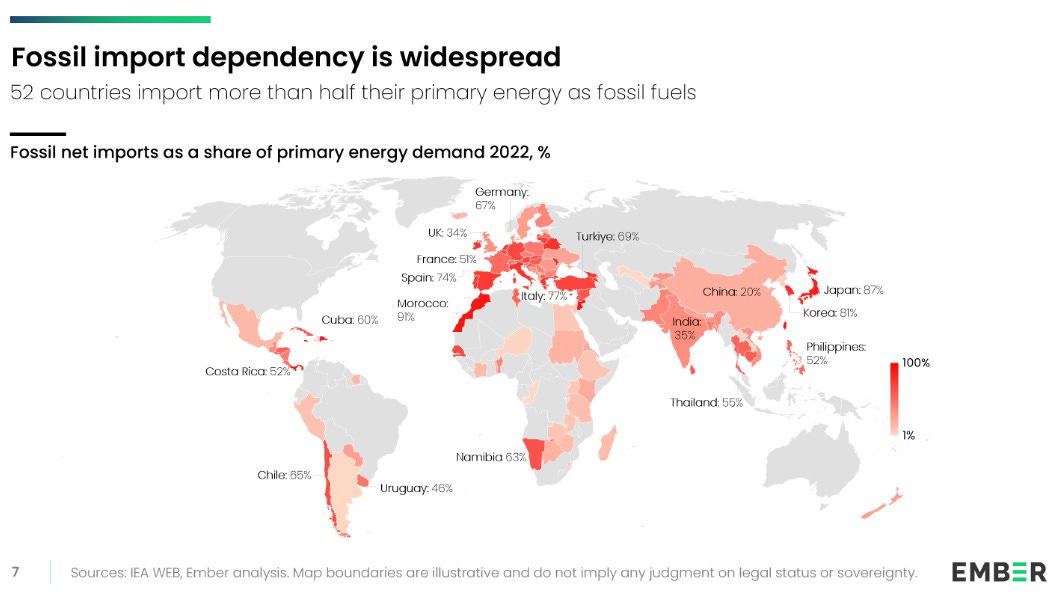

Some lots more than others – 52 (mostly large) countries import over half their energy via fossil fuels:

The world’s petrostates are familiar names such as Saudi Arabia, Iran, Iraq, Russia – familiar because they are not only synonymous with oil they are also synonymous with volatility, as long as global energy relies heavily on a singular commodity fuel.

So, here is the state of the energy world in 2025: oil and gas dominate energy consumption (58% of primary energy on a gross basis), petrostates dominate world supply.

But “energy transition” does not come to us alone as a simple technical fact.

However you measure oil and gas reserves, proven, probable, recoverable, undiscovered, and whether you include Venezuela’s or Canada’s vast supply of tar sands or not, the key fact with oil and gas reserves is that they are – finite, fixed, predetermined: memento mori.

Petrostates won the prize of dominating their access to fossil fuels, and the world now lives with their distribution rights.

We have about 1.9 trillion barrels of oil that are economically viable left (at most), and we use up about 36 billion barrels per year - that works out at about 55 years of oil left, before the last drop is burnt.

Now – the engineering pragmatist will tell you that we can keep adding to reserves via exploration and production improvements each year, enough to make up for the annual drawdown of 2%. Maybe forever, says the engineering optimist by his side.

But.

In the past few years many large oil and gas companies have only replaced about 80% of their own reserves: meaning that for companies such as Shell and Chevron their remaining oil reserves actually measure less than 10 years.

Quickly re-creating engineering muscle memory, on declining global oil and gas basins, to replace the lost years of replacement, is not a simple feat.

This puts a huge reliance therefore on especially Middle East national oil companies to continue to expand their reserves basins.

For the international firms at least it is a system of retreat, strategic surrender to the geologic aging of fossil fuels.

So on the demand side, we – the oil and gas importers, ie most of us, - have recognised the need to switch to alternative energy, which is why the energy transition we defined at the start becomes so crucial.

In this framing the energy transition is not a matter of morality or even a need for lower emissions (even if that is a clever by-product), or even better economics and efficiency, which are also key factors.

It is a far more sober and serious issue – it is a matter of necessity, as fossil fuels are finite, and now failing the most basic global technical limit- having not much more than 50 years of supply left – at current consumption rates.

Electrostate, a fundamental systemic shift in energy

Let’s start with a definition upfront to avoid being accused of jargon.

An 'electrostate': a nation where electrical energy technologies such as solar, wind, batteries and EVs including manufacturing, domestic adoption, and exports forms a cornerstone of economic strategy."

It aligns with but differs from a petrostate definition.

The alignment is that both are nations where energy “technology” is at the forefront of their economic focus: electrostates via manufactured materials, petrostates through oil and gas.

The difference is that electrostates have to develop a sophisticated manufactured system of energy technology, to use domestically and abroad, whereas petrostates need only extract and exploit the largesse of nature’s oil and gas deposits landed at their doorsteps – and which may easily surpass domestic needs by sheer volumetric luck.

The world of energy is therefore on the cusp of divergence.

So – can there be or indeed is there an electrostate?

By the definition above, the answer is – yes, there is one already.

The wider question then becomes – will there be many others, will we all become energy electrostates?

To begin, China defines the first energy electrostate – but this is a systemic shift, not a China label

The term is still emerging, just as the technology itself remains brand new, but the case for China as an electrostate seems strong.

It is able to supply the new (low-cost) energy technologies to power domestic and global electric grids, and then electrify energy demand via innovative economic products in many industrial sectors (power, transport, industry, heat) to receive the new cheap electricity – home and abroad.

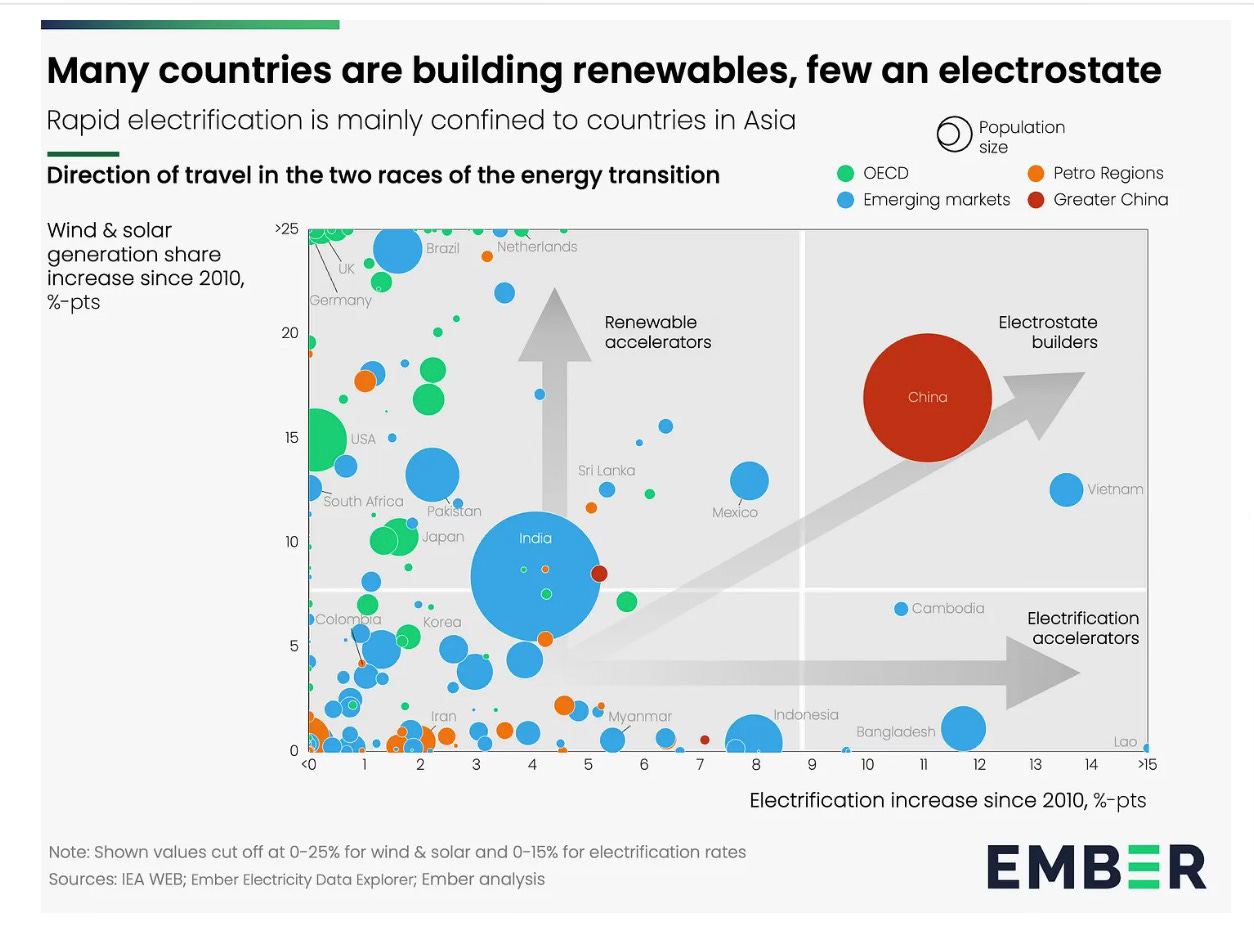

This is a race which China is winning so far: it clearly has a lead in the overall electro-state development, fuelling electricity generation with renewable technologies (wind, solar, batteries) – and also electrifying its energy system to receive this new efficient energy production eg in transport (EVs) and heat (heat pumps) – a very concise analysis here from Ember.

But - adding renewables to the grid, and electrifying energy demand is a necessary but not sufficient condition of being an electrostate.

An electrostate then has to be able to export all these manufactured energy elements - renewable energy supply technologies and electrified energy demand products - to other countries at competitive economic cost.

This is a high new energy bar – but for China it is however underway.

Lacking oil and gas - as noted here - China in a giant cliché moment has turned energy necessity into a vast array of energy invention.

Taking each element of manufacturing, domestic deployment and exports in turn.

Manufacturing: As energy technologies such as wind, solar, batteries and electric vehicles quickly arise, so China has begun to dominate each one, domestically, and now internationally via exports.

Wind and solar are already 20% of global electricity supply from almost 0% in 2000.

China dominates this market nationally and internationally with for example 80% of world solar panel production.

In the supply chain behind all of these new energy technologies China dominates with over 40% in all key mineral processing resources such as lithium and copper,

All told investment in these new energy manufactured technologies has risen to over $3 trillion per year by 2025, or double the investment in oil and gas extraction: and 50% of this investment rests with China.

In batteries for storage their national leaders CATL and BYD control 60% of world lithium-ion battery supply, and BYD again is the market leader in global electric vehicle sales, overtaking Tesla in Q1 2025 (see above in the title opening).

All told latest estimates are that electric energy technology make up about 9% of China’s GDP (compared with 1.5% in the US).

Domestic adoption: Electric vehicles now make up 25% of new global car sales (from 0% in 2015), on the road toward 50% of new sales by 2030, removing 3-4 million barrels per day of demand for oil by then (enough to cause world-wide peak in gasoline sales, as covered elsewhere).

China’s sales of plug-in EVs nationally is now close to 55%, a rise of 40% from last year.

And its local adoption of wind and solar means it installed last year (2024) 333GW of solar power, triple the capacity of 2 years earlier, and accounting for 50% of world solar capacity.

So much so that its emissions from the power sector peaked in Q1 2025, as it has now forced coal and gas from its power grid at an accelerating rate – a global milestone that is little remarked, but does support the likely rise of an electrostate.

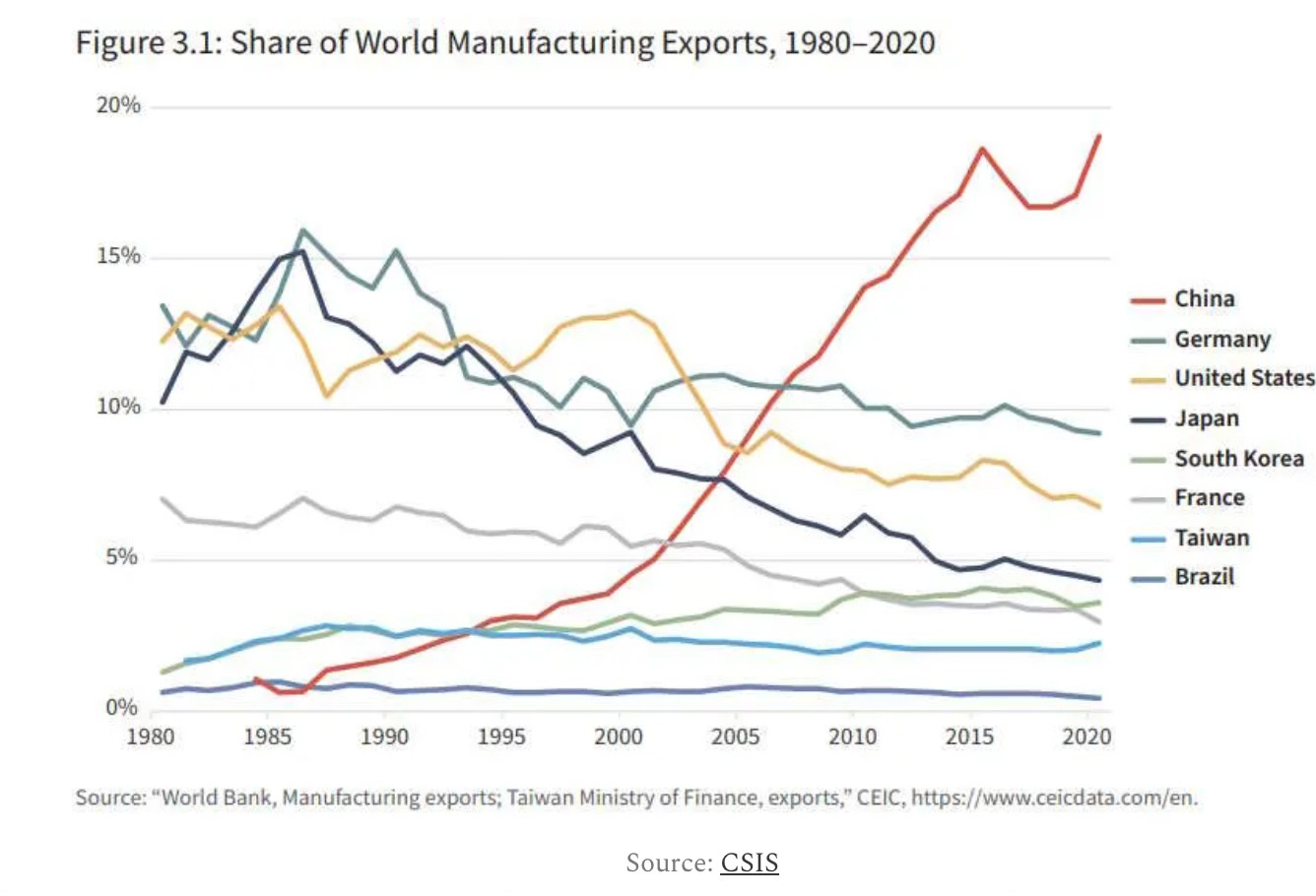

Exports: China is now the largest exporter of manufactured goods in the world (20%), from less than 5% in 2000 – a large proportion being manufactured energy goods such as solar panels, batteries and electric cars.

And it is now the largest exporter of cars in the world (mostly EVs) with 30% export market share from less than 5% as recently as 2021 – from footnote to leadership in four years.

China’s renewable energy trade surplus is already over $200bn pa, and is closing in on the petrostate surplus of eg Saudi Arabia.

So China meets the criteria of manufacturing expertise, domestic adoption and export revenues and strength.

Hence, China may well be the first electrostate.

And that changes everything: because China is a very big manufacturing entity, and is now creating energy from a very large and fast-growing, well-resourced base.

The future of energy: transfer, not distribution

This fancy new term electrostate is more than linguistic novelty: it signals a new energy mindset in the making.

Petrostates, governing world energy today, are largely a matter of luck (resource geolocation) – a binary outcome of having enough natural reserves of exportable exajoules, a fundamental unit of energy, or not.

Electrostate power, the future of global energy, however is created through industrial policy, manufacturing skill, and technological innovation – it's replicable (though difficult) and benefits massively from increasing returns to scale and learning curves.

Electrostates have the ability to manufacture exajoules, and just not rely on inheriting them.

So in theory any country can be an energy electrostate.

The technologies are accessible, the local implementation feasible, and export opportunities can be created.

So far, only China meets the high bar of industrial economic leadership in manufacturing, high adoption rates of new energy technologies such as solar, batteries, and EVs, and a clear industrial policy designed to export these large-scale electrification technologies.

So - how many electrostates will there be?

There can only ever be a handful of large petrostates as we’ve discussed: this is largely determined by geological happenstance.

And electrostates ? There are barriers to electrostate proliferation.

An energy electrostate club could grow: Germany, the US, South Korea for example all have large manufacturing capabilities, but domestic deployment of electrotech energy is fragmented in each, meaning they lag export capability too.

This is for a variety of reasons, many to do with dealing with legacy fossil-fuel dependent industries, mindsets - plus large developed economies outside China seem to lack an industrial policy vision of new energy technology development and deployment. The US in particular appears to now be drifting away from new energy leadership.

In their latest dispatch on substack here at the Electrotech Revolution , Kingsmill Bond, Daan Walters and Sam Butler-Sloss outline what it take to be a true electrostate – summing up in a concise diagram: clean technology generation of electricity, and that electricity becoming central to energy usage – and then the ability to export these electrotech sources of energy supply and demand to other nations in economic products and services.

Renewable energy electricity grids are an obvious win for developed and developing economies – but electrifying energy beyond power into transport and other sectors (and then exporting that capability) seems to be an imaginative step too far for many at the moment.

Except, today at least, China – see the chart.

And add another dimension - the time to become a viable electrostate may not be lengthy: manufactured energy scales at very fast rates once it gets started: China’s rise to electric vehicle dominance for example has taken less than 10 years: from standing start to supremacy.

Working with this example, Germany, in contrast, has been reluctant to lead EV battery technology – preferring for 3-4 crucial years in 2018-2022 to dabble with in-house battery technologies or create more efficient combustion engines.

In exponential time, that might be a fundamental error. A time that perhaps cannot be caught up.

Now that the most economic battery chemistries have been developed in China, creating a world standard in LFP blade design, the ability to create a new alternatives seems almost over. Germany’s likeliest best alternative is to work with Chinese battery makers, as it is now doing, whilst at the same time discovering a major export market for its cars has disappeared in a matter of 60 months.

More widely, China's scale and manufacturing focus gives it a unique first-mover advantage in new energy. Its government spends almost 3 times as much on electric vehicles than the US, and 5 times as much as the EU.

The energy transition therefore is not just a move toward solar or EVs, it is the total re-thinking of the energy system, to solve the seemingly undefeatable challenge of finite fossil fuels.

In theory we might only need one major electrostate, as long as its knowledge of energy can be transferred globally, rather than forever be dependent on the daily petrostate energy supplies we rely on.

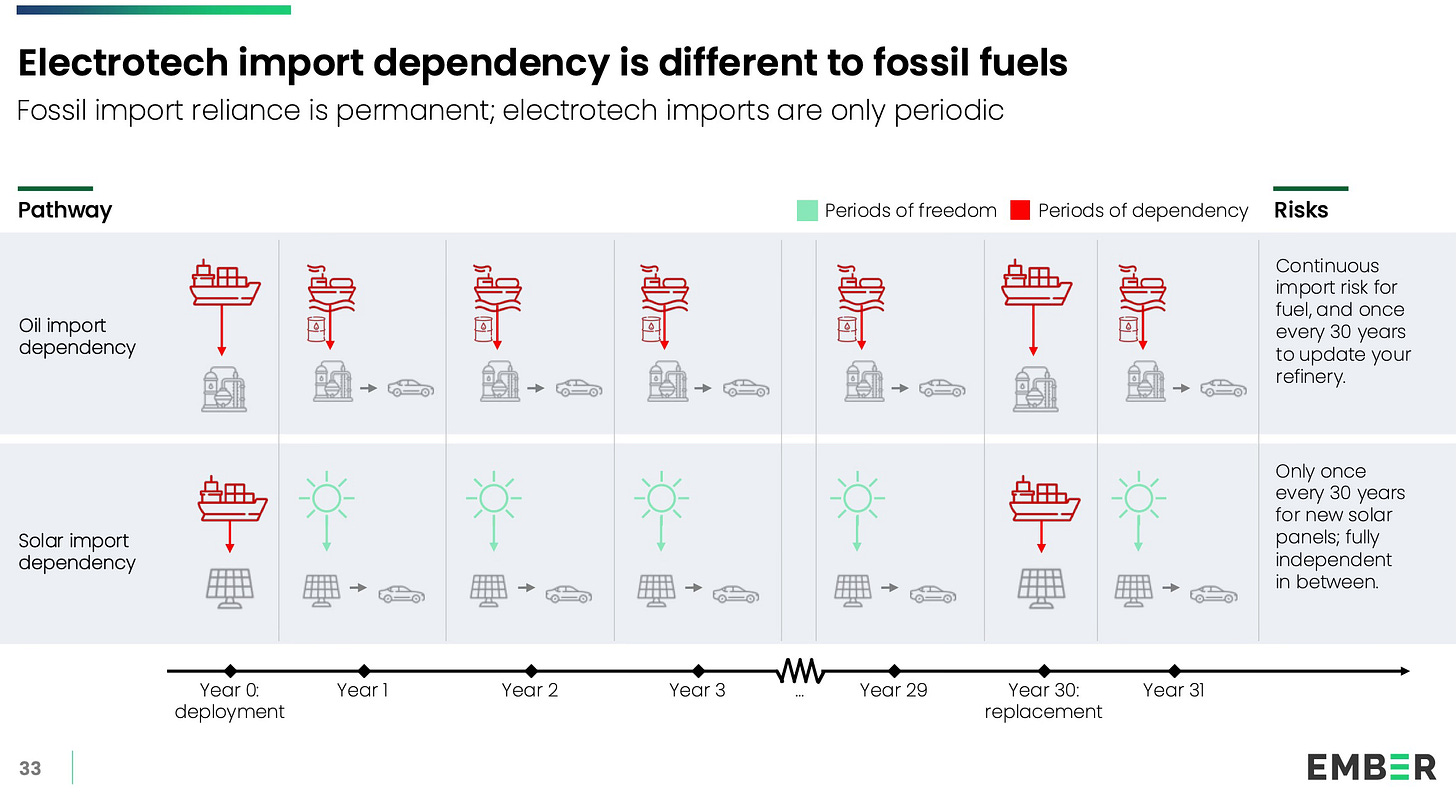

The clear and obvious risk is we swap one dependency on petroleum for that of electrotech developed by China.

But that may well misconstrue how energy is transforming.

The coming century will rely on the dispersed transfer of energy, rather than the centralised distribution we depend on today.

As the chart below shows depending on a transfer of energy stock – eg solar panels or EVs – that can last for decades, is very very different from the daily reliance on oil and gas distribution from afar.

Once manufacturing enters the energy arena, we have the power to innovate various forms of energy and energy products, and choose the sources we use, whether or not we implement China’s exact technologies.

In contrast, oil will always be an energy system of looking at the horizon waiting for the next shipment. It is a system of who controls the tap.

With oil we have never had an energy choice as long as we chose the commodity route.

With manufactured energy we have a long path of energy innovation ahead of us, if we choose to take it.

We have one electrostate now perhaps – but also with guile and expertise and some canny contracts we can all become 21st century electrostates, finding ways to manufacture, deploy and export clever new electrotech energy devices and services, already at work here, with Octopus Energy in the UK partnering with China’s BYD to create free EV charging.

Energy is being freed from geologic determinism, and moving fast toward replicable and scalable commercial and technical creativity.

Electrostates , at various scales (international, national, regional) can be formed, and be an iterative energy system.

Where a solar panel or EV battery blueprint, or heat pump design can increase energy access without causing energy depletion.

That is the forever change.

As ever, the analysis here is my own, and may not reflect that of companies I am involved with. Take it and run with it as you please.

I wanted to like this essay, especially as I read the first half. The concept of an Electrostate is an awesome one. It describes China.

However, your coverage of Germany and its (former?) manufacturing ability is seriously flawed. You completely omitted the _Atomaussteig_ and its consequence which has been Germany's abandonment of its manufacturing and engineering ability.

Kudos for covering the Petro States of the Middle East and Venezuela, albeit briefly. Entire books could be written about what happens to societies that are too dependent on fossil fuel exports. I've seen the negative consequences of a collapsing Petro state with my own eyes as the Venezuelan collapse triggered the enormous migration of 2015-6 through 2020 when COVID put a stop to most of that.

Along with a reasonably full discussion of China and its electrification, you briefly mentioned China's nuclear build along with, obviously, their almost total penetration of wind, solar, and battery manufacturing. Would have liked to read a bit more about China and nuclear manufacturing and repeatability.

Your essay will form the base of some important discussions here.